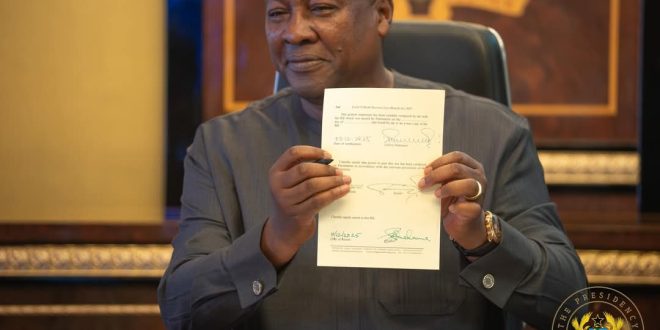

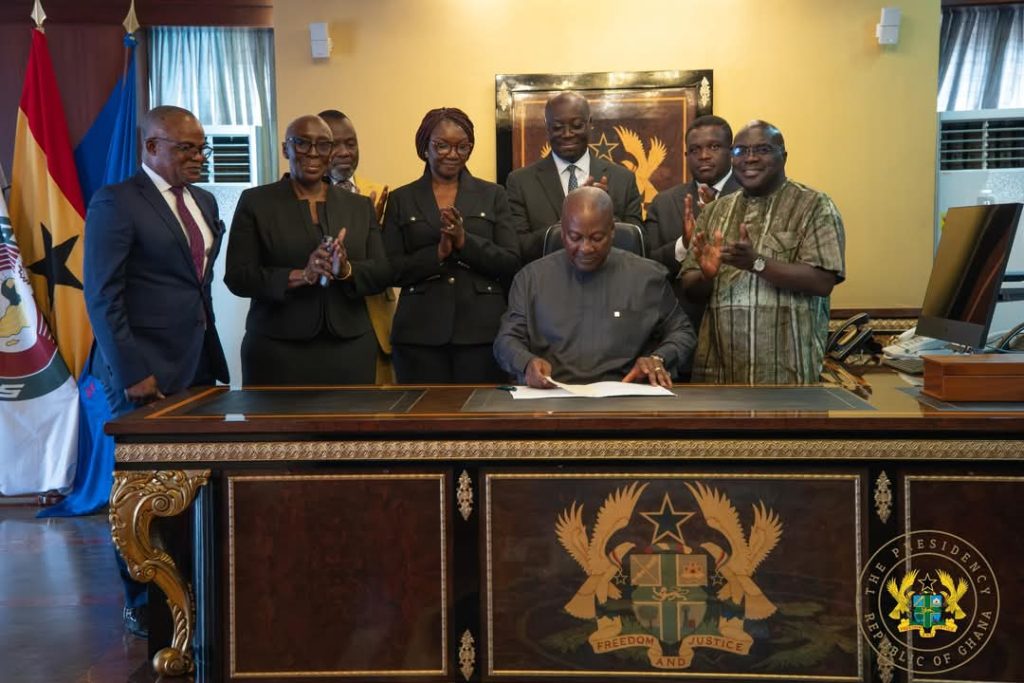

President John Dramani Mahama has signed into law the COVID-19 Health Recovery Levy Repeal Act 2025, officially abolishing the 1% levy imposed on the consumption of goods, services, and imports during the peak of the COVID-19 pandemic.

The repeal follows Parliament’s approval last month and forms part of the government’s broader commitment to eliminating so-called “nuisance taxes” in a bid to reduce the cost of living for households and ease operational pressures on businesses.

The COVID-19 Health Recovery Levy was first introduced in 2021 under the COVID-19 Health Recovery Levy Act (Act 1068). Signed into law on March 31, 2021, the Act imposed a 1% charge on the value of taxable supplies of goods and services, as well as on imports—except those exempt under VAT regulations.

The levy was applied in addition to existing consumption taxes, including the Value Added Tax (VAT), the National Health Insurance Levy (NHIL), and the GETFund levy, drawing criticism from businesses and consumer groups who argued it contributed to rising costs.

With the President’s assent on Wednesday, the repeal is set to take effect in January 2026, eliminating the additional 1% charge for both consumers and enterprises. The government says the move is expected to ease economic burdens and support recovery efforts across various sectors.

Adoa News Adoa News

Adoa News Adoa News