Ghana’s fixed-income market is fast establishing itself as one of Africa’s most credible and resilient bond platforms, recording a total turnover of GHS214 billion so far in 2025.

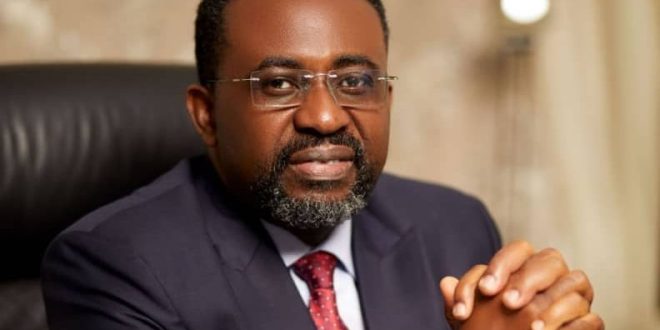

According to the Governor of the Bank of Ghana, Dr. Johnson Pandit Asiama, the milestone marks not only a recovery from Ghana’s recent debt crisis but also the dawn of a new era of regional financial leadership.

Speaking at the 10th Anniversary of the Ghana Fixed Income Market (GFIM) in Accra, Dr. Asiama said the market’s resurgence demonstrates Ghana’s readiness to anchor regional capital market integration under the African Continental Free Trade Area (AfCFTA) Financial Integration Framework.

“Our goal is to make Ghana the reference point for transparency and innovation in African fixed-income markets. We have moved from rebuilding trust to leading by example,” he said.

Dr. Asiama noted that Ghana is aiming to become a regional benchmark for transparency, innovation, and sustainability, comparable to Nigeria’s FMDQ and Morocco’s Casablanca Finance City, both of which have evolved into continental hubs for financial services.

The Governor acknowledged that the transformation follows a turbulent period for Ghana’s financial markets. During the domestic debt exchange, trading volumes on the GFIM fell sharply from GHS230 billion in 2022 to GHS98 billion in 2023, as investor confidence in the government’s fiscal credibility weakened.

However, by October 2025, trading activity had rebounded to GHS214 billion, signaling a robust resurgence of investor confidence and restored market stability.

Dr. Asiama described the recovery as both a financial and emotional test for Ghana’s economy — one that taught policymakers three key lessons:

“Credibility is capital — without it, no reform endures. Predictability breeds confidence — markets price stability before they price returns. And coordination is protection — fiscal and monetary policies must align.”

He credited the sharp rebound to improved coordination between fiscal and monetary policy, alongside consistent efforts by the Bank of Ghana and the Ministry of Finance to reinforce market discipline.

According to the Governor, Ghana’s broader macroeconomic turnaround — including a decline in inflation from 54 percent to 8 percent, a 35 percent appreciation of the cedi, and reserves covering nearly five months of imports — has significantly bolstered investor sentiment and deepened liquidity on the GFIM.

“Behind every decline in inflation lies a rise in discipline, and behind every cedi of appreciation lies a recovery of trust,” Dr. Asiama remarked, adding that Ghana’s bond market has once again become a mirror of the country’s economic recovery.

Looking ahead, Dr. Asiama said the next decade of the GFIM’s growth will focus on depth, diversity, and digitalisation, creating a market that “not only trades bonds but transforms economies.”

With its renewed credibility and modern trading infrastructure, Ghana’s fixed-income market is being positioned to play a pivotal role in continental capital market integration under the AfCFTA framework.

Adoa News Adoa News

Adoa News Adoa News